Retirement calculators are a popular topic, and for good reason. They’re one of the best ways to monitor whether you’re “on track” for retirement, and many of them are free. Even if you’re already retired, they can be a useful tool to insure your money lasts longer than you do.

The problem many of us have is determining “which is the best retirement calculator?” I don’t think there’s a definitive answer to that question, and would urge you instead to run several calculators and compare the results. If you’ve not yet used a retirement calculator, I encourage you to pick one from the “My Favorite Retirement Calculators” section below and give it a try.

I’ve been planning on writing this article for a long time, and have taken a lot of time putting it together. It’s a lengthy post, but I encourage you to work through it. Retirement calculators are your friend. Get to know them. Start today, with this article. Retirement calculators will help you Achieve A Great Retirement. It’s for that reason that I’ve invested the effort to write this article, and I sincerely believe you will benefit if you read through it and take action as a result.

There are some bloggers which I’ll link to later in this article which have done far more exhaustive reviews than I plan to do here. My main purpose of this article is to provide you with a few of the best retirement calculators that I’ve found, and currently use. Rather than flood you with a list of dozens of calculators, I’m going to highlight the calculators that I’ve found to be “best” for me. For more on the wider universe of retirement calculators, see the “In Depth” section at the end of this article.

With that, let’s get started.

Garbage In, Garbage Out

Before you begin the use of any retirement calculator, it’s important to realize any of them will only be as good as the information you enter into the calculator. Take the time to gather as accurate an estimate as possible on the many variables which are required. As this article and this article warn, inputs are critical to getting the best advice from any retirement calculator. For my retirement planning, I maintain a spreadsheet with all of my major assumptions, including my current investment balances, my projected investment balances at retirement, retirement income, and my retirement spending assumptions. I keep my “assumption file” open on one screen while entering the data into the retirement calculator on a second screen. Here is a summary of the key inputs you should calculate BEFORE starting to input data into any calculator:

- Targeted retirement age

- Retirement living expenses: baseline and “exceptions” (e.g., cars)

- Retirement income streams (pension, Social Security, etc)

- Current Assets by tax classification (pre-tax IRA, after-tax Roth, etc)

- Projected savings rate from now until retirement

- Risk tolerance

- Housing situation (Mortgage paid off? Property taxes)

You should also have a list of assumptions you maintain, which can be varied on some calculators to determine the impact on your probability of retirement success:

- Returns by major asset class

- Inflation

- Tax assumptions

Take some time to develop these “inputs” first. They’re basic building blocks you’ll need for your retirement planning, and it’s easier to develop them before you start playing with calculators. I know the tendency is to open up a calculator and start playing (trust me, I’ve been there), but you quickly realize that approach doesn’t work. Once you see the results of the calculator, you immediately realize they’re not worth much, since you didn’t take the necessary time “up front” to put together solid assumptions. Remember this:

Even the best retirement calculators are only as good as the assumptions you use in the model. Share on XThe Problem: 3 Unknowns

Regardless of which retirement calculator you use, they all face the same dilemma in trying to solve for “retirement readiness”. There are “3 Unknowns”, summarized below (for more details, see this excellent article by Darrow Kirkpatrick, my favorite author on the topic of retirement calculators). By definition, the answer to these “unknowns” is unknown, and yet your ability to retire is fundamentally tied to each:

The Growth Rate: What will the economic growth rate be from now until you die? The returns of various asset classes is tied to the performance of the economy overall, and yet there’s no solid way to estimate the future growth of various economies. Personally, I’m a bit pessimistic about the current state of affairs, and prefer to use a more conservative assumption in my growth rates and projected returns. (Hey, if it turns out I’m wrong we’ll have more money than planned. Not a bad scenario, and better than being overly optimistic and end up running out of money in your 70’s).

The Inflation Rate: This is the one variable that I worry about more than the others. Investopedia refers to inflation as “Retirement’s Silent Killer”, and for good reason. The loss of spending power from your retirement assets can be devastating. Play around with various inflation assumptions in the retirement calculator of your choosing, and you’ll see what I’m talking about. In my detailed “Retirement Cash Flow” spreadsheet, I’ve built the ability to enter different inflation rates for every major spending category. It works for me, and allows me to fine tune potential inflation against my projected spending to monitor the impact. This is also the reason why the “experts” encourage folks to maintain some exposure to stocks, even after retirement. The bottom line: don’t underestimate inflation, it’s a potential killer.

Your Life Span: Planning for retirement would be easy if you knew when you were going to die. It’s probably good that we don’t know… When I use calculators, I assume a long life (95 for me, 97 for my wife). I don’t want to retire until I know that we’ll be ok even if we live a long life. Assume 110, and you’ll never be able to retire. Assume 75, and you run the risk of outliving your money. Again, play with various assumptions, and watch the impact. Be conservative in whatever scenario you ultimately use when finalizing your target retirement date.

To best solve for these “unknowns”, I like calculators that let you change the assumptions used, and dislike the “black box” approach where you don’t really know what assumptions the calculator is using. For that reason, I tend to favor calculators that allow the user to adjust various assumptions. There are simplified retirement calculators available (Kirkpatrick calls them “low fidelity”), but I tend to prefer the “higher fidelity” models for my personal retirement planning. Low fidelity calculators are good for getting a quick check on your general progress, but once you enter The Red Zone of retirement (5 years or less) I’d encourage you to focus on the higher fidelity models.

My Favorite Retirement Calculators

Retirement Calculators are your friend when planning for retirement. Here are the best, pick one and try it! Share on XI’ve intentionally put “the best part” of this article far down into the post. It’s important to understand the issues I’ve outlined above BEFORE you start playing around with calculators. With that said, here are my favorite retirement calculators. (click on title to view websites)

The Flexible Retirement Planner

The Number One retirement calculator in my opinion. This has been called “possibly the most powerful free calculator on the web” by Darrow Kirkpatrick, and I trust his opinion. It can be run fairly simply (read through their documentation link for a quick tutorial, if necessary), while also allowing many adjustments that will keep you fascinated for hours. I like the use of Monte Carlo simulations, and the output screens showing “probability of success”. It allows easy “what if” scenarios to adjust the “3 Unknowns” and monitor the impact. It has both a “summary” and a “detailed” view of the model output, allowing you to look into a tremendous amount of detail for every year of your life. If you haven’t explored this calculator yet, I strongly encourage you to do so.

Personal Capital Retirement Planner

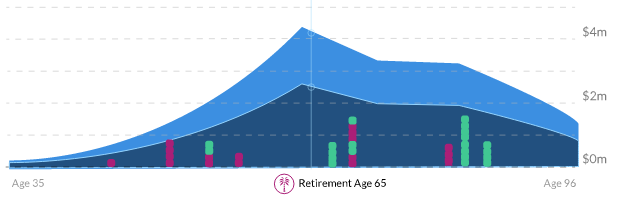

There are many things I like about Personal Capital, and their relatively new retirement planner just adds to the charm. As I mentioned in my “Year-End Checklist” article, I already use Personal Capital to track all of our investment accounts, and automatically capture my net worth and asset allocation at the end of every year. Since all of my investments are already captured and fed into the calculator, it’s the easiest of the three calculators to work with. It’s a bit lower fidelity (level of detail) than my #1 pick above, but the lower fidelity does result in a calculator that’s a bit more “user friendly”. It’s got some nice graphical outputs (the best of the 4 calculators reviewed here), and uses Monte Carlo to calculate a probability of success. My Personal Capital results always seem a bit more optimistic than the results I get from #1 (The Flexible Retirement Planner), a result of the inability to adjust expected asset class returns in the Personal Capital model. I tend to prefer a more conservative assumption on future returns, and this is one good example of why I recommend that you never rely on any single calculator for your retirement planning. Given the ease of use and the well designed graphics, Personal Capital makes it to my list of The Best Retirement Calculators.

MarketWatch Retirement Planner

In my opinion, the MarketWatch calculator is the “lowest fidelity” calculator which I’d be comfortable using. Typically, “low fidelity” strips away many of the tools that make these calculators useful, so I tend to stay away from them. With MarketWatch, however, you’ll get a high level look at how you’re doing toward retirement, ease of use, and yet maintain some ability to influence assumptions. It has some nice features on the “advance settings” tab where you can adjust your assumption for investment returns, tax rates, life expectancy, and inflation rates by major spending category. Results are presented in easy to understand graphics.

T Rowe Price Retirement Income Calculator

This calculator won the Alliance Star Award for best retail online innovation, and it’s an excellent calculator. The output graphs are excellent, and include easy to understand comparisons of alternative scenarios (change some assumptions, see the impact). Includes Monte Carlo analysis, and “probability of success” output. A bit “higher fidelity” than Personal Capital and MarketWatch, but not as complex as The Flexible Retirement Planner. A great compromise, and I encourage you to give it a look.

NewRetirement

2018 Update To Post: The folks at NewRetirement have recently made some incredible updates to their retirement calculator, and I’d strongly encourage folks to consider this among the “Best Of” Class in 2018. One thing nice about NewRetirement – they offer various levels of involvement. For example, you can use their amazing retirement calculator for free, like the others shown here. However, you can also “hire” them to help you run the calculator, or you can let them manage the entire process for you. That level of flexibility is interesting, and a great option for someone who’s nervous about “Do It Yourself” retirement planning, yet doesn’t want to pay the prices a “typical” Certified Financial Planner would charge you for a review. Most importantly, their retirement calculator is Best In Class with their new updates and easy to use if you simply want to do it yourself.

How I Use Retirement Calculators

I typically run a different retirement calculator every month or two, just to try out different calculators and see the results. Once you’ve captured your assumption data, it’s easy to run multiple models. For my “Four Favorite Retirement Calculators”, I’m a bit more intentional. I run each of the calculators every 6-9 months, and capture the output of the calculators every time I run them. I “store” the output (sometimes via a screen capture) in a spreadsheet specifically dedicated to tracking calculator results. It’s very interesting to look back over previous “runs” of the calculators, and compare them to the latest version. As I get closer to retirement, the numbers are getting more fine tuned, and the output from these calculators is encouraging. Even if you’re already retired, I’d encourage you to play around with a few calculators to help you monitor how your portfolio is holding up to your retirement spending.

In addition, I maintain a manual Retirement Cash Flow model, which I update each year when I update my net worth. Using the calculators in addition to my spreadsheet gives me the confidence that I’ve got a “cross check” in place to insure I don’t overlook anything in this critical area.

The Best Retirement Calculators – In Depth Reviews

As I mentioned earlier, the purpose of this post is to focus on those calculators which I personally use. I’ve read many articles on retirement calculators, and played around with a dozen or more of what appear to be the more popular calculators. It’s an interesting exercise, and I’d encourage you to try it yourself. If you’re using a calculator which I haven’t included in my review, add a comment to this article and I’ll have a look!

To aid in your review, summarized below are some of the best Retirement Calculator articles I’ve found, followed by links to the recommended calculators. Click on the title for the full article, or click on the calculator name to head straight to the calculator.

The 3 Best Free Retirement Calculators – Darrow Kirkpatrick. Nice article, where he runs the exact same scenario through three calculators and compares the results. His conclusion on the best three: Vanguard Nest Egg Calculator, The Ultimate Retirement Calculator by Todd Tresiddor, and (my favorite) The Flexible Retirement Planner.

My Favorite Retirement Calculators – Darrow Kirkpatrick. A 2016 update to the article above, with an overview of some of his favorites based on over 80 calculators he’s reviewed to date. I know of no one who has studied retirement calculators more than Darrow, and encourage you to study him if you’d like more details on the subject.

A List Of The Best Retirement Calculators: An exhaustive list by Darrow Kirkpatrick, with summaries and links to 24 of the best retirement calculators on the web. Worth a look.

About Money: Retirement Calculator Review: A well written article with excellent reviews on 8 top calculators.

A Podcast On Retirement Calculators: Todd Tressidor interviews Darrow Kirkpatrick. Two legends in the field discussing retirement calculators, worth a listen.

Summary

I’ve played with a lot of calculators, and many have positive attributes. Defining “The Best Retirement Calculator” is an impossible task. More important is to simply pick a few calculators and get started. Take some time to compile the assumptions you’re going to use before you start, and you’ll find it’s quite easy to run a few calculators and compare results. Take advantage of the free tools that are “out there”, some are quite good. Use any of the four retirement calculators summarized in this article, and you’ll be well on your way to Achieving A Great Retirement.

Great overview of the problems and the sites that can solve them.

I will keep them for later, once the date is closer.

You really hit all the points Fritz and your knowledge of the different calculators is very impressive. Thanks for sharing all this info. For us (24 and 23) it’s hard to have a picture in mind of what we will achieve, so for now we are just aiming to do the best we can, invest as much as we can and hopefully with time our lives will get easier.

Tristan

Tristan, the very fact that you, in your early 20’s, are reading up on personal finance is all I need to know. You’ll be successful. I did exactly what you’re doing when I was your age – I started learning, and I saved as much as I could. For the next 15 years, that’s all you need to focus on. Congratulations on the early start!

Great information Fritz. I’m saving this post for when we run the numbers again before we pull the plug! I like Darrow Kirkpatrick a lot. I find Wade Pfau extremely helpful too because he does so much research.

I’m sure the calculator I’m using is very simplistic but I’m just using the Planning system built into my 2010 version of Quicken for Home or Business. I was using a calculator that I really liked a lot on Fidelity’s site but they took it down. I figure their attorneys convinced the powers that be that they were too much at risk for lawsuits if it turned out their calculator was wrong.

I will take a look at the others you recommend. Thanks for the great blog article. My wife and I are getting ready to retire early next year. Our business and our city home should be sold by then and we will pay off the little bit left on the mortgage on our retirement home in the mountain town we have chosen.

I may have to go back to work for a little while after we do some traveling with our travel trailer.

Thanks so much for all of the great information.

The Flexible Retirement Planner ask for a credit card. Have you had any issues with this.

Vito, I’ve not had that issue on my end. In fact, if you click on the “Licensing” tab you’ll find this statement: “The Flexible Retirement Planner is free for use by individuals for non-commercial purposes.” Not sure why you’re having that issue, may be worth having another look? Sorry for any issues you may be having.